We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

BRO Stock Trading at a Discount to Industry at 19.69X: Time to Hold?

Read MoreHide Full Article

Key Takeaways

{\"0\":\"BRO leverages strategic acquisitions to capture market opportunities, completing 702 acquisitions since 1993.\\r\\n\",\"1\":\"BRO\'s diverse business model and operational expertise support a robust liquidity position.\\r\\n\",\"2\":\"BRO has raised dividends for 30 consecutive years, with a five-year (20192024) CAGR of 8.7%.\"}

Brown & Brown, Inc. (BRO - Free Report) shares are trading at a discount compared with the Zacks Brokerage Insurance industry. Its forward price-to-earnings multiple of 19.69X is lower than the industry average of 19.79X and the Zacks S&P 500 Composite’s 23.39X.

The insurer has a market capitalization of $29.98 billion. The average volume of shares traded in the last three months was 3.3 million.

Shares of Aon plc (AON - Free Report) , Marsh & McLennan Companies, Inc. (MMC - Free Report) and Willis Towers Watson Public Limited Company (WTW - Free Report) are also trading at a discount to the industry average.

Image Source: Zacks Investment Research

Shares of Brown & Brown have lost 11.9% in the past year compared with the industry’s decline of 19.4%

Image Source: Zacks Investment Research

BRO’s Encouraging Growth Projection

The Zacks Consensus Estimate for Brown & Brown’s 2025 earnings per share indicates a year-over-year increase of 8.3%. The consensus estimate for revenues is pegged at $5.83 billion, implying a year-over-year improvement of 21.3%. The consensus estimate for 2026 earnings per share and revenues indicates an increase of 15.7% and 26.6%, respectively, from the corresponding 2025 estimates.

Earnings have grown 21.5% in the past five years, better than the industry average of 15.2%. Brown & Brown's bottom line outpaced estimates in three of the trailing four quarters and missed in one, the average surprise being 5.64%.

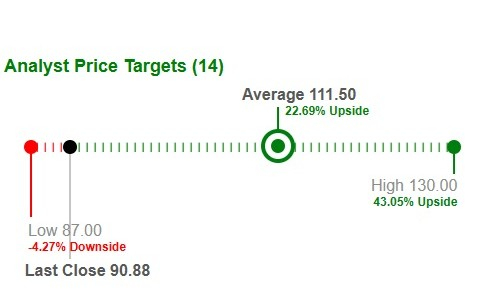

Average Target Price for BRO Suggests Upside

Based on short-term price targets offered by 14 analysts, the Zacks average price target is $111.50 per share. The average suggests a potential 22.6% upside from the last closing price. Image Source: Zacks Investment Research

Factors Impacting BRO

Commissions and fees, the main component of the top line, benefit from increasing new business, strong retention and continued rate increases for most lines of coverage. The company met its intermediate annual revenue goal of $4 billion, doubling in the last five years.

The insurance broker continually makes investments in boosting organic growth and margin expansion. It has an industry-leading adjusted EBITDAC margin.

Brown & Brown’s strategic buyouts help it capitalize on growing market opportunities, strengthen its compelling products and service portfolio, expand global reach and accelerate its growth rate. From 1993 through the second quarter of 2025, Brown & Brown acquired 702 insurance intermediary operations. The Quintes buyout was the largest transaction in 2024.

Banking on operational expertise, BRO boasts a strong liquidity position with an improving leverage ratio. The strength of its operating model and diversity of businesses ensures strong cash conversion. The company effectively deploys cash into acquisitions, capital expenditure and wealth distribution for shareholders via dividend increases.

BRO has an impressive dividend history. The strong capital position enables Brown & Brown to distribute wealth to shareholders via dividend increases. For dividend payments, the company has increased dividends for the last 30 years at a five-year (2019-2024) CAGR of 8.7%.

End Notes

New business, strong retention, rate increases, strategic buyouts and impressive dividend history position the company well for growth. Favorable growth estimates and positive analyst sentiment are other positives. A robust capital position over the years reflects its financial flexibility.

Image: Bigstock

BRO Stock Trading at a Discount to Industry at 19.69X: Time to Hold?

Key Takeaways

Brown & Brown, Inc. (BRO - Free Report) shares are trading at a discount compared with the Zacks Brokerage Insurance industry. Its forward price-to-earnings multiple of 19.69X is lower than the industry average of 19.79X and the Zacks S&P 500 Composite’s 23.39X.

The insurer has a market capitalization of $29.98 billion. The average volume of shares traded in the last three months was 3.3 million.

Shares of Aon plc (AON - Free Report) , Marsh & McLennan Companies, Inc. (MMC - Free Report) and Willis Towers Watson Public Limited Company (WTW - Free Report) are also trading at a discount to the industry average.

Image Source: Zacks Investment Research

Shares of Brown & Brown have lost 11.9% in the past year compared with the industry’s decline of 19.4%

Image Source: Zacks Investment Research

BRO’s Encouraging Growth Projection

The Zacks Consensus Estimate for Brown & Brown’s 2025 earnings per share indicates a year-over-year increase of 8.3%. The consensus estimate for revenues is pegged at $5.83 billion, implying a year-over-year improvement of 21.3%. The consensus estimate for 2026 earnings per share and revenues indicates an increase of 15.7% and 26.6%, respectively, from the corresponding 2025 estimates.

Earnings have grown 21.5% in the past five years, better than the industry average of 15.2%. Brown & Brown's bottom line outpaced estimates in three of the trailing four quarters and missed in one, the average surprise being 5.64%.

Average Target Price for BRO Suggests Upside

Based on short-term price targets offered by 14 analysts, the Zacks average price target is $111.50 per share. The average suggests a potential 22.6% upside from the last closing price.

Image Source: Zacks Investment Research

Factors Impacting BRO

Commissions and fees, the main component of the top line, benefit from increasing new business, strong retention and continued rate increases for most lines of coverage. The company met its intermediate annual revenue goal of $4 billion, doubling in the last five years.

The insurance broker continually makes investments in boosting organic growth and margin expansion. It has an industry-leading adjusted EBITDAC margin.

Brown & Brown’s strategic buyouts help it capitalize on growing market opportunities, strengthen its compelling products and service portfolio, expand global reach and accelerate its growth rate. From 1993 through the second quarter of 2025, Brown & Brown acquired 702 insurance intermediary operations. The Quintes buyout was the largest transaction in 2024.

Banking on operational expertise, BRO boasts a strong liquidity position with an improving leverage ratio. The strength of its operating model and diversity of businesses ensures strong cash conversion. The company effectively deploys cash into acquisitions, capital expenditure and wealth distribution for shareholders via dividend increases.

BRO has an impressive dividend history. The strong capital position enables Brown & Brown to distribute wealth to shareholders via dividend increases. For dividend payments, the company has increased dividends for the last 30 years at a five-year (2019-2024) CAGR of 8.7%.

End Notes

New business, strong retention, rate increases, strategic buyouts and impressive dividend history position the company well for growth. Favorable growth estimates and positive analyst sentiment are other positives. A robust capital position over the years reflects its financial flexibility.

However, given its premium valuation, it is better to wait for some more time before taking a call on this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.